Company : The Commissioner of Commercial Taxes, Odisha

Head Quarters : Cuttack

Industry : Government Tax

Service / Product : Government Tax Service

Website : https://web.odishatax.gov.in/

Odisha Tax Technical Support Number

Toll Free Number : 1800-345-6753

Hotline Number : +91-8260820848

IT Cell : +91-671-2304922 / 2303865

Related / Similar Service : Odisha Discoms Toll Free Number

e-Mail : ctdho AT odishatax.gov.in

Note :

If your complaints are not attended within 3 working Days you please write to – osd2 AT odishatax.gov.in

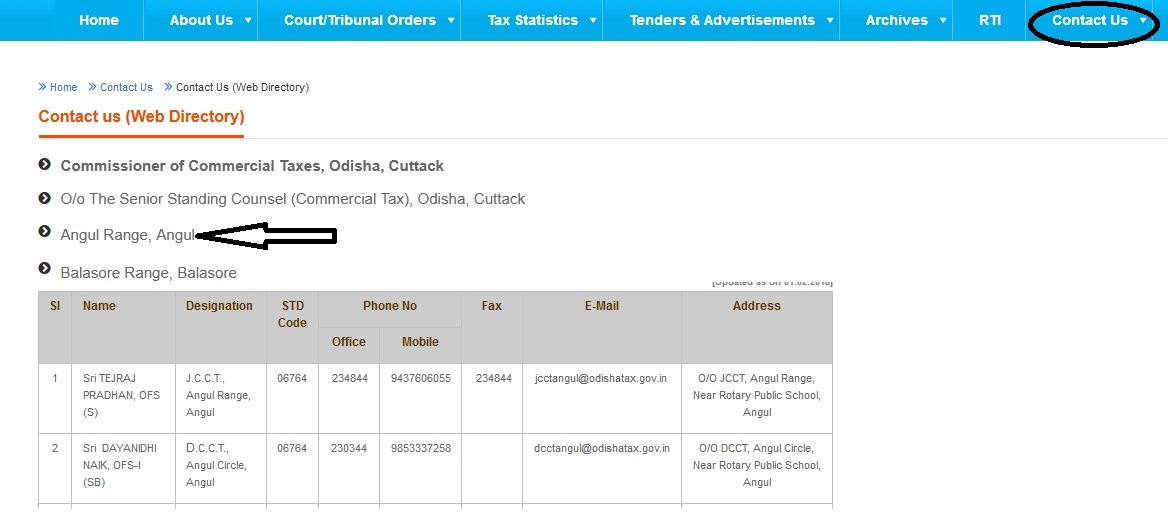

Contact Address

The Commissioner of Commercial Taxes, Odisha

Banijyakar Bhawan

Old Secretariate Compound

Cuttack – 753 001.

ODISHA

Phone : 91-671-2305033

Fax : 91-671-2304077

email: cct AT odishatax.gov.in

About Us

The Commercial Tax Organisation came into being on the 1st April, 1947 with Head Quarters at Cuttack for collection of Sales Tax. It was in-charge of the “Collector of Commercial Taxes, Odisha”. As the Head of the Organisation, the post of “Commissioner of Commercial Taxes, Odisha” was created w.e.f. 24th August, 1956.

The “Commissioner of Commercial Taxes, Odisha” replaced the “Collector of Commercial Taxes” w.e.f. 29th May, 1957. The Organisation remained under the administrative control of the Finance Department of the Govt. of Odisha upto the 29th November, 1951. From the 30th November, 1951, administrative control was transferred from the Finance Department to the Revenue (Commercial Taxes) Department, Sambalpur. Again the administrative control was transferred to Finance Department w.e.f. 28th October, 1956.

View Comments (6)

My name is Dr Kwame Appiah,i am a British-Ghananian. I work with a Multi-National Pharmaceutical Company as a Procurement Manager but was promoted recently as a Regional Manager and transferred to our Nigerian Office. My company is into manufacturing of pharmaceutical materials.

There is a raw material which my company used to send me to buy in India. Right now I have been promoted to the post of a Regional Manager hence my company cannot send me to India again to buy the materials.

The Director of my company has asked me for the contact of the supplier in India but I refused to give it to him.This is because I don't want the company to have a direct contact wth the local dealer so as not to know the actual price i used to buy the product from the local dealer.

To this regard,i need a trustworthy and reliable person who i shall introduce to my company as the supplier in India. You will now buy the product from the local dealer and supply to my company. The profit would be shared between you and me on a 60/40 %.60% to me while 40% to you. If you agree to do the supply, I will tell you at what rate you will sell the product to my company.

If you are interested kindly contact me for more details.

WHEN IM A NON GST DEALER,IM DEALINGS F.L.SHOP WHY MY TIN NO BLOCKED. I CANT FILE MY VAT RETURN SO WE CANT RECEIVE VAT CLEARANCE FROM PURI CIRCLE,PURI MY TIN -21581107565 M/S. MOHANTY TRADERS

I am a public consumer, a purchaser. As per aadhaar number I am not entitled to buy essential commodities from consumer shops. I need to know if I should be registered as a customer in commercial tax office or only merchants are customers. Then why do they register as merchants?

Additional CTO AngulI/u used to collect bribe from a bus & the case was detected by JCCT Angul & CTO I/u Angul. A statement was recorded from the conductor of the bus for confrontation. But for what purpose it was suppressed instead of conveying the the matter to CCT(O). Also similar allegations were against the said officer previously.

My TIN IS 21717000098.

I FORGOT MY PASSWORD & SECURITY QUESTION WITH ANSWERS OF MY ABOVE TIN.

HOW CAN I OPEN MY PORTAL SITE?

I booked to Move Flat in Bhubaneswar dated 04 Jan 2016.That, the Total consideration Amount mentioned in the Sale Agreement is Rs.40,33,403/- which I have almost paid and have got the same registered in my name in July 2016. The builder has levied service tax 4.5% and VAT @ 3.5% thereupon on the consideration amount. I, therefore, request you to guide me whether service tax and VAT payable to Central Govt. & State Govt respectively is really applicable to me or not. If yes what percentage of VAT should I have to pay and from which effective date?